התרחבו במהירות עם הכישרונות הטובים ביותר, כבר מההתחלה.

הרכבת הצוות הטוב ביותר שיהפוך את החזון שלכם למציאות היא השלב הראשון עבור חברת סטארט-אפ. איתנו קל למצוא, לגייס, ולנהל כישרונות מובילים בכל מקום בעולם. בעוד אתם מתמקדים בצמיחה, אנו מטפלים עבורכם בכל צורכי התאימות, השכר ומשאבי האנוש.

התרחבו מהר.

הוסיפו כישרונות חדשים למילוי תפקידים חיוניים והרכיבו צוותים עוצמתיים תוך דקות ספורות.

השקיעו במה שחשוב.

השקיעו את הכסף שלכם במוצר או בשירותים שאתם מציעים ותנו לנו להתמקד בתהליך ההרכבה והניהול של הצוותים המתרחבים שלכם.

הרחיבו את הצוות שלכם.

קבלו תמיכה בכל שלב ממומחי משאבי האנוש שלנו, הזמינים 24/7, ישירות בפלטפורמה.

המוצרים המומלצים

שלנו לצמיחה עבור חברות סטארט-אפ.

הכלים הכי פופולריים שלנו תוכננו כדי לצמוח איתכם.

גייסו והעסיקו במהירות את הכישרונות הטובים ביותר בעולם.

גייסו והעסיקו את הכישרונות הדרושים לכם לבנייה נכונה של הצוות שלכם, בכל מקום בעולם, מבלי להקים ישויות חדשות. אנחנו מטפלים עבורכם בהכול, במהירות ובתאימות, כך שאתם יכולים להשקיע את הזמן והכסף בהרחבת החברה שלכם.

מידע נוסףחשבו עלויות לפני שאתם מגייסים.

הבינו מהי העלות הנלווית של העסקה במדינה ספציפית כדי שתכירו את התמונה הפיננסית המלאה לפני ביצוע הצעד הבא שלכם, ותוכלו לבחור את האזורים הטובים ביותר לגייס מתוכם.

מידע נוסף

צרו בקלות חוזי העסקה תואמים לדרישות.

בתור ה-Employer of Record הגלובלי שלכם, G-P מאפשרת לכם ליצור אוטומטית חוזים תואמים לדרישות ולגייס ולהעסיק חברי צוות חדשים באמצעות ה-Global Growth Platform™ המובילה בתעשייה – ללא כל צורך בהקמת ישויות במדינות אחרות.

מידע נוסף

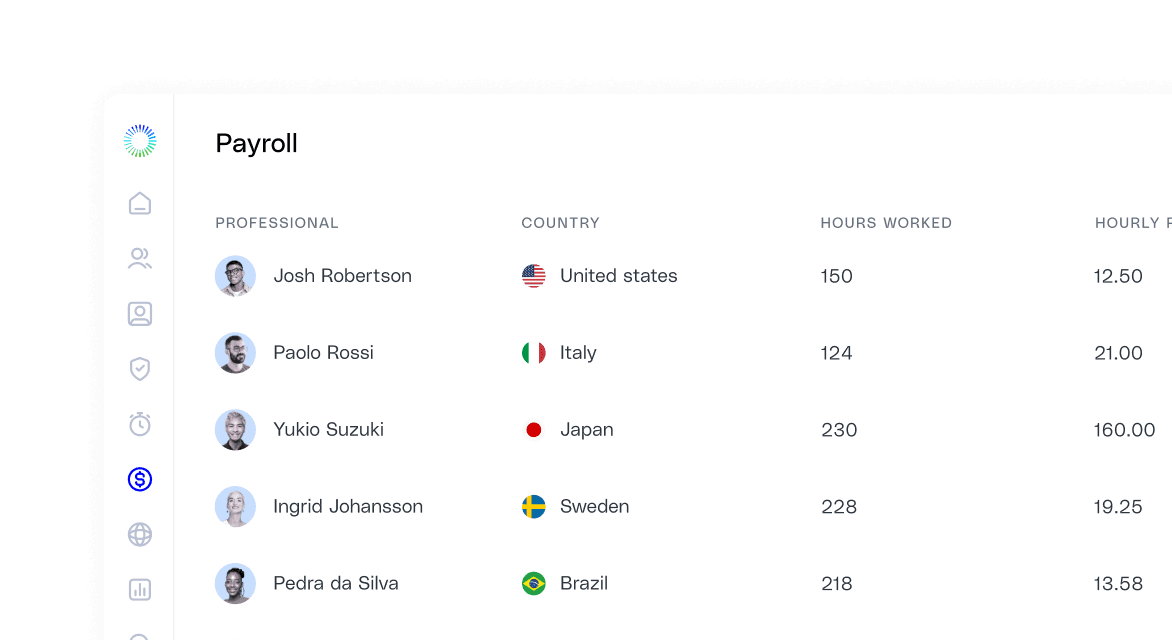

שלמו לצוותים שלכם בכל מקום בקלות.

אל תדאגו בנוגע להקמת מערך שכר גלובלי, אנחנו נעשה את זה בשבילכם. אנו מנהלים תשלומים ברמת דיוק של 99% ביותר מ-180 מדינות, במבחר מטבעות, באופן המתאים ביותר לעסק שלך.

מידע נוסףזוכה לאמון של חברות מתרחבות בכל מקום.

אל תסמכו רק על המילה שלנו.

חשיבה גלובלית. מהרגע הראשון.

ארצות זמינות

דיוק בשכר

שותפים עסקיים גלובליים

שביעות רצון לקוחות

ארצות זמינות

דיוק בשכר

שותפים עסקיים גלובליים

שביעות רצון לקוחות

ארצות זמינות

דיוק בשכר

שותפים עסקיים גלובליים

שביעות רצון לקוחות