In Indonesia, employer of record (EOR) products and services play a crucial role in complying with the country’s complex employment regulations. They ensure that employment processes, from hiring to termination, meet local legal requirements. AI-powered EOR services cover everything from legal employment contracts to managing Indonesia payroll taxes, ensuring seamless operations for businesses.

By tapping into the expertise of an employer of record Indonesia, companies can confidently navigate diverse regulatory requirements, minimizing legal risks. EOR support reduces the risk of non-compliance, enabling businesses to concentrate on their core activities and freeing them from the complexities of local legal and tax requirements.

Hiring in Indonesia with an EOR

Navigating Indonesia’s complex labor laws, such as drafting compliant contracts and calculating termination pay, requires deep local expertise, which the Employer Record EOR provides. An EOR acts as the legal employer, ensuring every aspect of your employment relationship complies with current regulations, such as the Omnibus Law (Law No. 6 of 2023).

Employment contracts in Indonesia

It is legally required that all employment contracts in Indonesia be written in Bahasa Indonesia. While a bilingual version may be provided, the Bahasa Indonesia version will always prevail in case of any dispute or discrepancy.

Contracts can be for a fixed term (PKWT) or an indefinite term (PKWTT), with adherence to Indonesian labor laws. Fixed-term contracts can be for a maximum period of 5 years. It is mandatory to draft a strong, compliant employment contract that details compensation, benefits, and termination requirements. All monetary values must be stated in Indonesian Rupiah (IDR).

Working conditions in Indonesia

Indonesia working hours and overtime

The standard workweek in Indonesia is 40 hours, typically structured as 8 hours per day for 5 days a week or 7 hours per day for 6 days a week. Overtime work requires written consent from the employee and must not exceed 4 hours per day and 18 hours per week. Overtime pay is calculated at 1.5 times the hourly wage for the first hour and 2 times the hourly wage for subsequent hours.

Indonesia public holidays

Employees are entitled to paid time off for public holidays. The Indonesian government announces the official list of national holidays and “collective leave” (cuti bersama) days annually through a joint ministerial decree. Major recurring holidays include:

-

New Year's Day

-

Lunar New Year

-

Nyepi (Balinese Day of Silence)

-

Good Friday

-

Labor Day

-

Ascension Day of Jesus Christ

-

Waisak Day (Buddha's Birthday)

-

Eid al-Fitr

-

Independence Day

-

Eid al-Adha

-

Islamic New Year

-

Birthday of the Prophet Muhammad

-

Christmas Day

Annual leave in Indonesia

Employees are entitled to a minimum of 12 days of paid annual leave after 12 months of continuous service. The government-mandated collective leave days (cuti bersama) are typically deducted from an employee's annual leave entitlement.

Sick leave in Indonesia

Indonesia does not have a fixed number of statutory sick days. Employees who are sick are entitled to paid leave as long as they provide a medical certificate. For prolonged illness, employees receive full pay for the first 4 months, which is then reduced to 75% for the following 4 months, 50% for the next 4 months, and 25% thereafter until the termination of employment, which is permissible after a 12-month absence.

Maternity and paternity leave in Indonesia

Birthing parents are entitled to 3 months of fully paid maternity leave, typically taken as 1.5 months before and 1.5 months after birth, ensuring compliance with local employment laws. Non-birthing parents are entitled to 2 days of paid paternity leave upon the birth of their child.

Compensation and benefits in Indonesia

Indonesia health insurance and social security

Employers must enroll all employees in Indonesia's universal social security system (BPJS), which consists of two programs: BPJS Kesehatan (Health Insurance) and BPJS Ketenagakerjaan (Employment Social Security). These programs provide coverage for healthcare, workplace accidents, old age, pensions, and death benefits.

Indonesia religious holiday allowance (THR)

A mandatory religious holiday allowance (Tunjangan Hari Raya or THR) must be paid to all employees. For employees with 12 months of service or more, the THR is equivalent to one month's salary. For employees with at least one month but less than 12 months of service, it is paid on a pro-rata basis. The THR must be paid at least 7 days before the employee's designated religious holiday, which is typically Eid al-Fitr by default.

Termination and severance in Indonesia

Terminating employment in Indonesia is complex and heavily regulated by the Omnibus Law. A probationary period of up to 3 months is permissible for indefinite-term contracts but is not allowed for fixed-term contracts.

The total termination payment is determined by the reason for dismissal and consists of three potential components:

-

Severance pay (uang pesangon): Calculated based on length of service, up to a maximum of 9 months' salary.

-

Long-service pay (uang penghargaan masa kerja): An additional payment for employees with at least 3 years of service, up to a maximum of 10 months' salary, must be adhered to for compliance.

-

Compensation rights pay (uang penggantian hak): Covers unused annual leave, repatriation costs, and other contractually agreed benefits.

The final payout is determined by applying a specific multiplier to these components based on the legal grounds for termination (e.g., resignation, redundancy, serious misconduct, retirement). Navigating these calculations requires expert knowledge to ensure compliance, which an Employer Record Indonesia can provide with ease.

Taxes in Indonesia

Indonesia social security contributions

Employers and employees contribute to the BPJS social security programs. Key contributions include:

-

Health insurance: 5% of salary (4% by employer, 1% by employee).

-

Old age savings: 5.7% of salary (3.7% by employer, 2% by employee).

-

Pension: 3% of salary (2% by employer, 1% by employee).

-

Work accident: 0.24% to 1.74% of salary (paid by employer, rate depends on industry risk).

-

Death benefit: 0.3% of salary (paid by employer).

-

Job loss security (JKP): This program is funded by the government through a reallocation of existing social security funds; there is no additional direct contribution from employers.

Indonesia personal income tax

Residents are subject to progressive income tax rates:

-

Up to IDR 60 million: 5%

-

Over IDR 60 million to IDR 250 million: 15%

-

Over IDR 250 million to IDR 500 million: 25%

-

Over IDR 500 million to IDR 5 billion: 30%

-

Above IDR 5 billion: 35%

Why G-P?

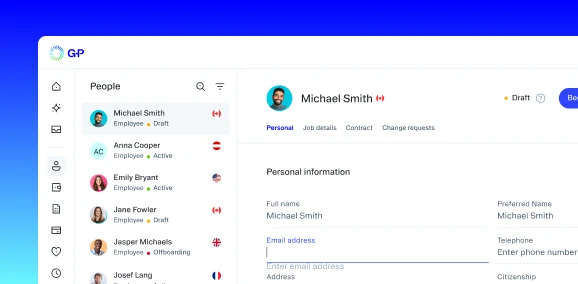

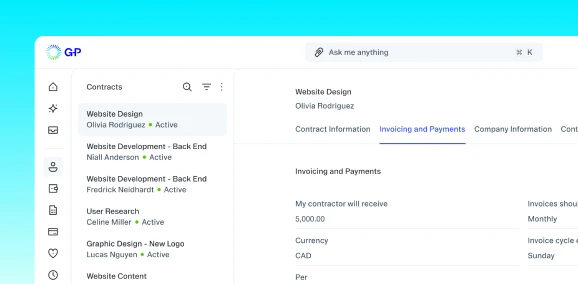

G-P EOR is the award-winning, AI-powered SaaS platform that empowers ambitious companies to build global teams. Onboard, manage, and pay top talent in over 180 countries in minutes, bypassing the typical time, cost, and complexity of local entity setup. G-P EOR is the preferred partner for leading HCM, PEO, and payroll platforms. Bring your workforce data together in one place to maintain existing workflows while guaranteeing consistent and accurate data across your integrated systems.

Request a proposal today to learn more.